Creating a More Engaging Super Experience

Saving for retirement is difficult to conceptualise: a dreadfully boring task so vast and seemingly endless that the eventual payoff is firmly behind the horizon.

This is why it’s so easy for retirement savings to fall into the category of “I’ll figure it out later when I have time”—and why so many people are falling behind with their superannuation funds.

In fact, around one in four Australians don’t even know they have a superannuation fund. Of those who do, the average super balance of today’s 65-year-olds is approximately $160,000 per person, which is considerably less than the $640,000 estimated for a comfortable retirement*.

Clearly, many Australians could benefit from new saving strategies so that they can be safe in the knowledge of affording a comfortable lifestyle in retirement. It goes without saying that super funds, as wealth managers, have an interest in their members achieving their savings goals as well. From the point of view of a digital agency, what can we do to help super funds make saving for retirement more exciting, and help their members grow their savings as a result?

Goal 1: creating a better way for people to estimate how much they will have by the time they retire

Creating better ways for people to understand if they are on track to a comfortable retirement, and helping them estimate what it will take to achieve this goal if they are not, is the first step towards fixing super.

Super fund members are, naturally, concerned about their funds’ returns – particularly in a year when many have lost money for the first time in a long time. Many are also not just concerned about their return but the good their money is doing in the world. They want to know that their money is being invested ethically and responsibly; 72 percent of Australians believe it’s important to consider environmental, social, and governance (ESG) parameters in their investment portfolios.

Some of the features we think would be most helpful are:

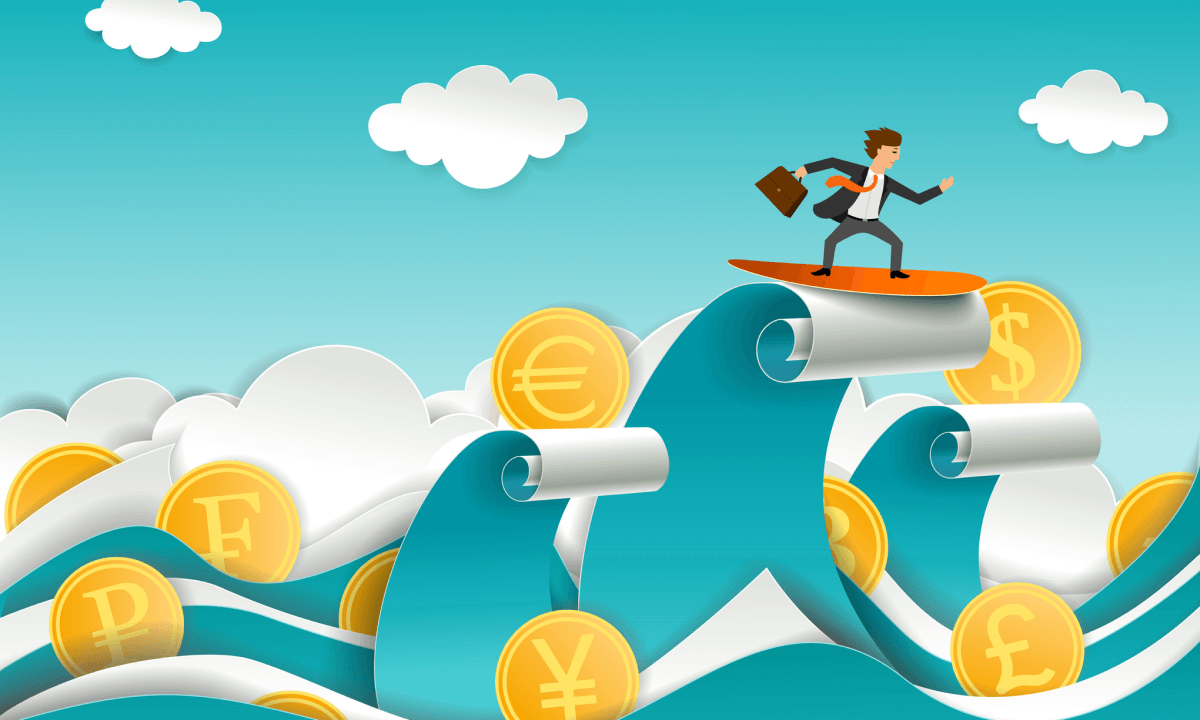

Providing transparent investment information:

Allowing people to clearly see their funds’ investments and enable them to feel proud of making a positive contribution with their super encourages members to stick around.

A recent project for Active Super reveals all their investments to the public for the first time, with options to view by investment strategy, category, country and company invested in, and more.

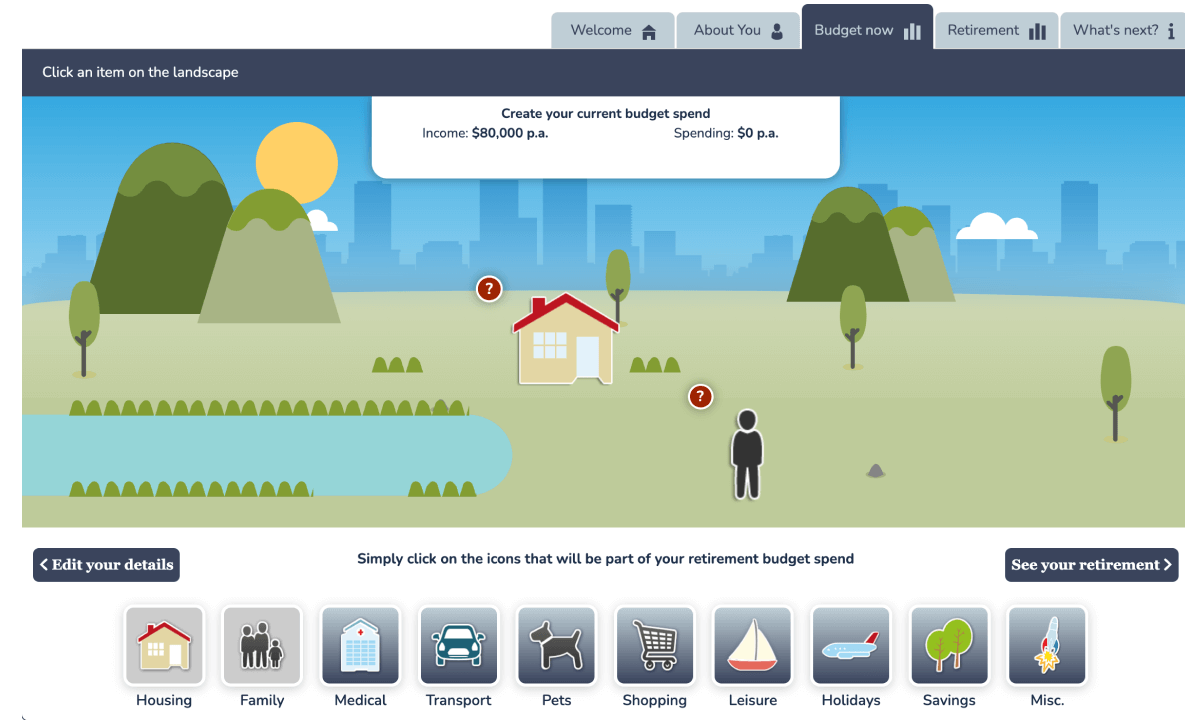

Re-imagining superannuation calculators:

Many super funds use calculators aimed at estimating savings by retirement age and incentivising savings. However, many of them are difficult for the average person to use and they ask for far more data than most of us have readily available.

Never mind looking outdated and being generic rather than on brand, these tools often miss opportunities to positively incentivise people, help them visualise goals and make use of short term rewards for long term goals. Super funds have much to gain from updating these tools that are often the first step to making consumers think about their retirement savings.

Once people know what their current situation is, it's important to also have tools in place for them to set financial goals and create budgets. Here’s where helping people focus on the short term can really help them grow savings in the long term.

Goal 2: shifting the focus to short-term rewards

With the payoff so far in the future that there's simply not enough incentive to get people to change their daily habits, we can need to employ other tools from our psychology toolkit to engage people.

Here’s some ways we can help shift the focus onto short-term rewards:

Gamification:

Help consumers experience short-term rewards typical of games such as a sense of mastery, winning a competition and escapism. Examples are:

- Make your goal something exciting – shift your focus from ‘put money into super’ to ‘sail around the world when I’m 65, maybe?

- Visualise tracking your net worth – saving's more fun when you can watch the numbers go up, particularly if they also show your goal

- Make your savings goal into a competition with a sibling, partner or close friend – up the stakes by playing for a prize or turning it into a drinking game.

- Invest money in something you believe in, then commit to putting the profits into your super fund – make sure to leave a little bit aside to reward yourself.

Challenges and competitions that focus on extra savings

Super funds could run competitions, challenges or promotions to get members to commit to a goal, for example:

- ‘Buy nothing week’ with the savings automatically put into their super fund

- A prize for members who increase their voluntary contributions by a small amount each week for a year

- Providing an option for rounding up every transaction they make and sending the difference to their super account

Regular updates:

Don’t forget to provide members with regular updates on how much closer they are to their retirement goals. Good ways to do this visualise the difference and tie the amounts saved back to lifestyle goals.

Together, these experiences make adhering to long-term goals more immediately enjoyable and therefore help consumers to achieve them.

However, this is clearly not the only solutions required. After all, it’s not just presentation that it is the issue, it is the investment strategies themselves. This will require new financial products and features that help people plan for their retirement.

Goal 3: help super funds transform their businesses

When we survey the superannuation landscape as it exists today, one word comes to mind: stodgy. In a world where technology has disrupted almost every other industry, superannuation funds have remained frustratingly old-fashioned.

Wealth management has traditionally relied on individual advisers and their personal qualities. However, their client base, and particularly younger potential customers, are engaging with new, digital investment and management products and independent of advisors. Super funds, like many other businesses in the sector, have fallen behind on transforming their products and business models for upcoming generation’s demands, still funnelling customers into personal advice products to grow their super. This is not only not meeting expectations, but is also compounded by the fact that financial advisors are an aging industry sector with many retiring professionals not being replaced by a new generation.

The future

We see the future of superannuation and wealth management as being digital, goal-oriented, and focused on the needs of the consumer. This means providing more and better tools for people to manage their money, as well as increasing transparency and more ethical investments.

The trends we see as worth focusing on are:

- The shift to digital: There is a growing expectation from consumers that they will be able to manage all aspects of their finances online. This includes being able to see their balance, make transactions, and get advice, all in one place.

- Ethical and social impact investing: As we mentioned, consumers are increasingly interested in where their money is being invested and what kind of impact it’s having. They want to know that their money is being used to make a positive impact.

- Democratisation of investment products: The rise of robo-advisors and online and mobile investing platforms has made it easier than ever for people to invest without the help of a financial advisor. This trend is only going to continue as more people become comfortable managing their own finances.

- Higher standards: With the introduction of the Consumer Data Right (CDR), customers will have more control over their data and how it’s used. This will likely lead to increased pressure on financial institutions to provide better products and services.

- Lower fees and greater transparency: The royal commission and other recent scandals have put pressure on financial institutions to lower fees and be more transparent about the way they make money. This is good news for consumers, who will enjoy more choices and better value for their money.

- Switching providers becoming more common: With younger people changing jobs more frequently and 54 percent of Australians wishing to consolidate all of their financial relationships in one place, switching providers is becoming more commonplace.

With the right products and services in place, we believe that more Australians will be able to save for a comfortable retirement—and they might even get excited about it.